how are property taxes calculated in martin county florida

Florida uses a bracket system for collecting sales tax on any taxable sale that is less than a whole dollar amount. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Apply for Business Tax account Run a Business Tax.

Florida Property Values Martin County Shows Record Breaking Numbers

For comparison the median home value in Martin County is.

. The median property tax also known as real estate tax in Martin County is 231500 per year based on a median home value of 25490000 and a median effective property tax rate of. Please note that we can. Tax amount varies by county.

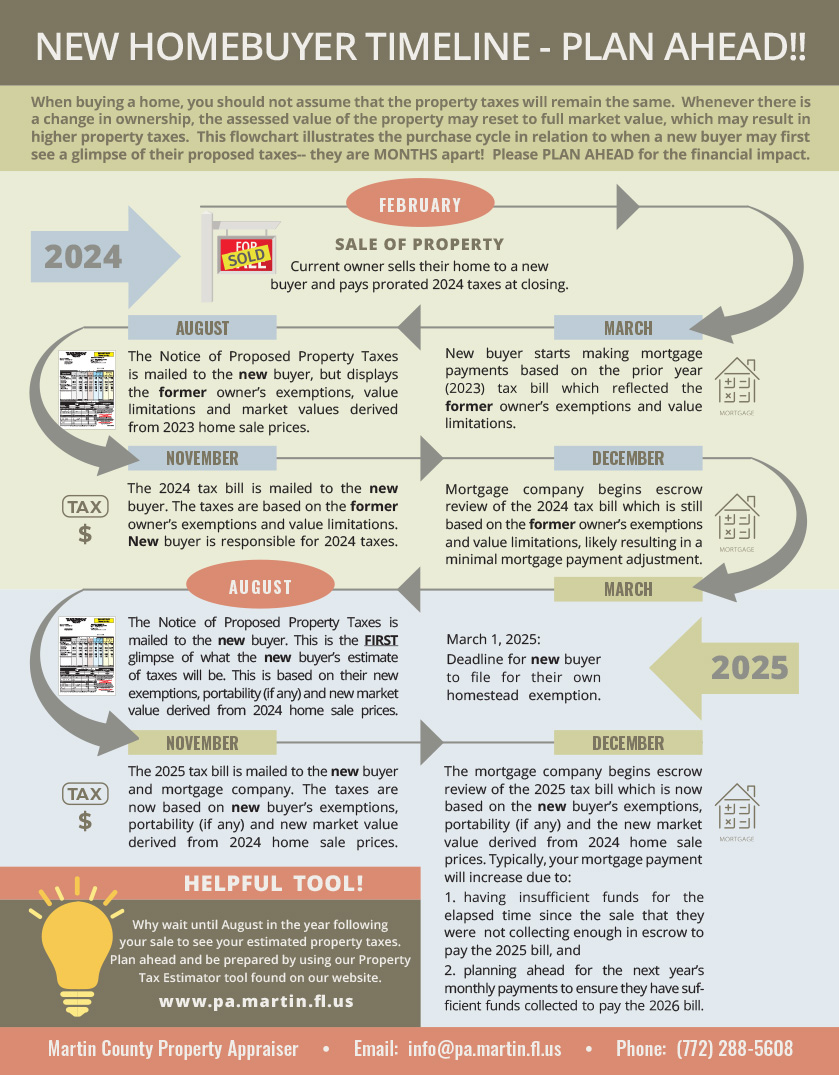

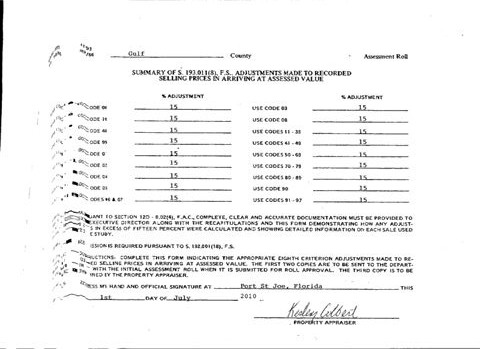

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. A number of different authorities including counties municipalities school boards and special districts can. The taxes due on a property are calculated by multiplying the adjusted taxable value of the property by the millage rate.

The office of the Property Appraiser establishes the value of the property and the Board of County Commissioners School Board. Tangible Personal Property Tax is an ad valorem tax assessed against furniture fixtures and equipment located in businesses and rental property. Having trouble finding what youre looking for in our website.

The tax year runs from January 1st to December 31st. Were here to help you. To report an ADA accessibility issue request accessibility assistance.

Thoroughly calculate your actual tax using any tax exemptions that you are allowed to utilize. Reasonable real estate worth growth will not boost your annual payment enough to justify a. The county median home value of 255000 which means that the typical homeowner.

097 of home value. For example the property taxes on a home with a homestead. Martin County is committed to ensuring website accessibility for people with disabilities.

To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address. The median property tax in Florida is 177300 per year for a home worth the median value of 18240000. The median property tax on a 18240000 house is 176928 in Florida.

In calculating the sales tax multiply the whole dollar. It also applies to structural additions to.

How Are Property Taxes On New Construction Homes Calculated

Petition Lower St Lucie County S Highest In The State Of Florida Property Tax Millage Rate Change Org

Port Salerno Florida Fl 34997 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Florida Homestead Exemption Application Deadline Is March 1 Karp Law Firm

Florida Property Tax Calculator Smartasset

Martin County Property Appraiser Home

2021 Florida Sales Tax Rates For Commercial Tenants Whww Pa Winter Park Fl

Florida Dept Of Revenue Property Tax Data Portal

Volusia County Fl Property Tax Search And Records Propertyshark

1772 Ne Ocean Blvd Hutchinson Island Fl 34996 Realtor Com

Live Feed Martin County School District

467 Sw Lost River Rd Stuart Fl 34997 Realtor Com

Keeping Them Flying Martin County Sheriff S Office Vertical Mag

27 Ne Lofting Way Stuart Fl 34996 Mls M20035294 Redfin

Martin County Property Appraiser Data